Many OFWs brave foreign lands and work diligently to support their loved ones back home. They show up tirelessly for others, sometimes forgetting about how they want to live when they retire. The earlier an OFW invests in a comfortable retirement, the bigger the rewards he or she can get. A comfortable and potentially rich retirement becomes attainable too.

If you are an OFW who dreams of a comfortable retirement, turning that dream into a reality can depend on the goals and plans you set as early as now, while you are still productive and working. Keep reading to find out more!

Have Zero Debt Before Retirement

The life of an OFW rarely means wealth and financial freedom. Almost all OFWs begin their careers abroad carrying a heavy burden of debt—then they continue incurring more debt because many people rely on them to survive.

Debt is an inevitable part of an OFW’s life. Thus, one of the sweetest victories of OFWs is to be debt-free when they retire. It’s liberating because nothing holds them back from spending their hard-earned money however they desire.

If you are an OFW who wants to have zero debt before retirement but do not know where to start, consider these strategies to pay your debts:

- Snowball method - focus on your smallest debt, pay the minimum on all other debts, and gradually pay off larger debts

- Debt Avalanche - focus on your largest and high-interest debt, pay the minimum on all other debts, and gradually pay off smaller debts

- Debt consolidation - combine all your debts into one account to possibly lower interest rates and avoid incurring other debts

Alternatively, you may consult a financial manager and seek personalized advice on how you can slowly settle your debts.

Have an Emergency Fund, a Life Insurance, and a Health Insurance

A peaceful retirement involves a secure fallback when emergencies happen. If you are an OFW who always buried yourself with work to support others, it’s high time you start investing in your own security.

Avoid scrambling for money and relying on your children or relatives when unexpected things happen. While you are still productive, prepare for the storms the future may bring.

Set up a retirement emergency fund to support unexpected home repairs, medical bills, or major economic crises increasing your cost of living.

If you do not have one already, avail of health and life insurance plans. When you apply early, you can get premium plans for cheaper costs.

When you are old, one of the best things you can have is security. Thus, investing in security and stability makes retirement truly golden.

Settle Pension Requirements

It is never too early to start planning your pension benefits when you retire. In fact, the earlier you contribute to pension options from institutions like the Social Security System (SSS), the bigger your monthly pension will be when you retire.

When you become a member, SSS allows you to estimate your pension depending on the number of your monthly contributions. It also provides benefits your family can claim when you become disabled or when you pass away.

Similar to SSS, Pag-Ibig also offers lucrative pensions and benefits for OFWs when they retire. OFW members can enjoy high dividend earnings, short term loans, and affordable housing loans, all of which can help build a comfortable retirement in the future.

Increase Your Income Streams

If you want a more affluent retirement, consider building multiple income streams while you can. Do not be afraid of building and growing your own business. When you are no longer an employee, successful businesses are reliable partners in overcoming financial difficulties and achieving financial freedom.

If you have spare time after a full-time job, you may also get side hustles to earn extra income. A little extra goes a long way. Your side hustle could even turn into big businesses, paying your debts and securing you that dream retirement life in a peaceful suburb.

Create a Retirement-Conducive Home

Are you an OFW saving up for your dream house back home? Settling back to the Philippines for good happens after retirement. To fully enjoy your dream house, invest in home designs and features that make growing old easier and more comfortable.

When you retire, your house will most likely be where you spend most of your time. Reward yourself with the relaxing and life-giving experience of staying in a house you love. To get a better idea of what retirement homes should have, check out how you can create an elderly-friendly home.

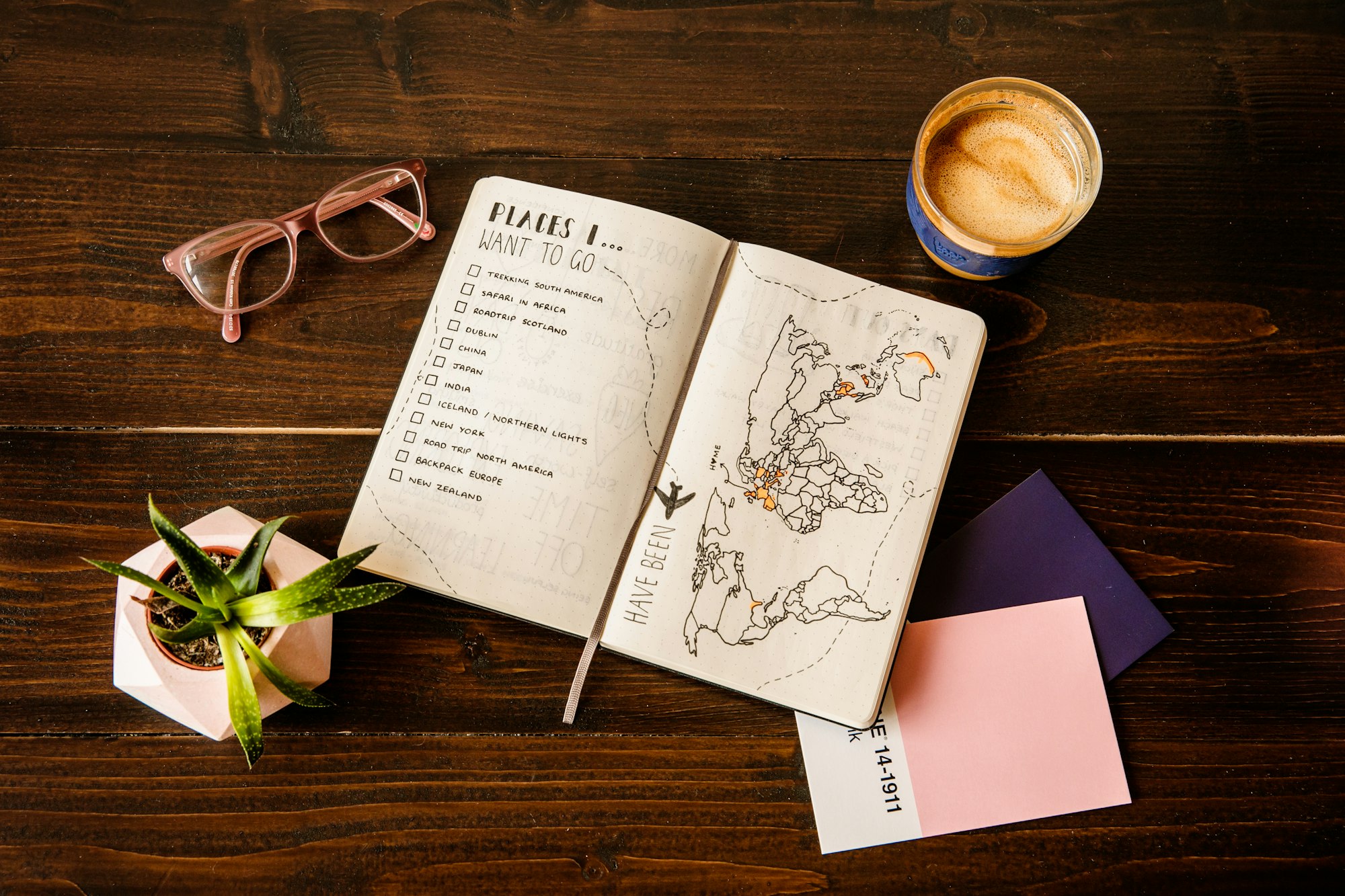

Create a Retirement Bucket List

Retirement does not always mean being fragile and slow. For OFWs who spent their lives living for others, retirement could just be a new chapter dedicated solely to pursuing their forgotten passions. Retirement could be the start of reclaiming the life an OFW sacrificed to support others.

Before retirement, make your retirement bucket list. List all the things you want to do but were not able to do because of your obligations. That list can be one of the things you look forward to when it feels like you have been left behind.

Why Retirement is Not the End

Retirement is an opportunity to start living again. It can be a time when you lay down your load and think of your own happiness—to do things you want to do. But a wonderful retirement is something you plan and invest in.

As early as now, make goals, list down your dreams, and visualize how you want to start again. No matter how small, your simple acts of investing in the future you want will earn rewards—security, peace, comfort, and freedom. With those rewards, who wouldn’t be excited to begin a new chapter after retirement?